Transparantie is één van de kernwaarden van Capital Circle. Als eerste crowdfunding platform publiceerden wij naast de successen ook de 'Verzuimgraad'. Dat zijn ondernemers die niet (meer) aan hun aflossingsverplichting kunnen voldoen. Ook dat hoort bij crowdfunding, vandaar het advies een beperkt gedeelte van uw vrij belegbare vermogen hiervoor aan te wenden en vooral te spreiden over meerdere projecten, risicoklassen, branches en looptijden.

Capital Circle zet zich in voor een transparante crowdfunding markt. De Europese verordening schrijft voor dat transparantie over de resultaten in het verleden een vast onderdeel hoort te zijn bij crowdfunding. Hieronder vindt u daarvan het resultaat aan. Maar let op: de crowdfunding markt is relatief nieuw en volop in ontwikkeling. In het verleden behaalde resultaten bieden geen garantie voor de toekomst.

De eerste lening via Capital Circle is verstrekt juli 2015.

Portefeuille statistieken

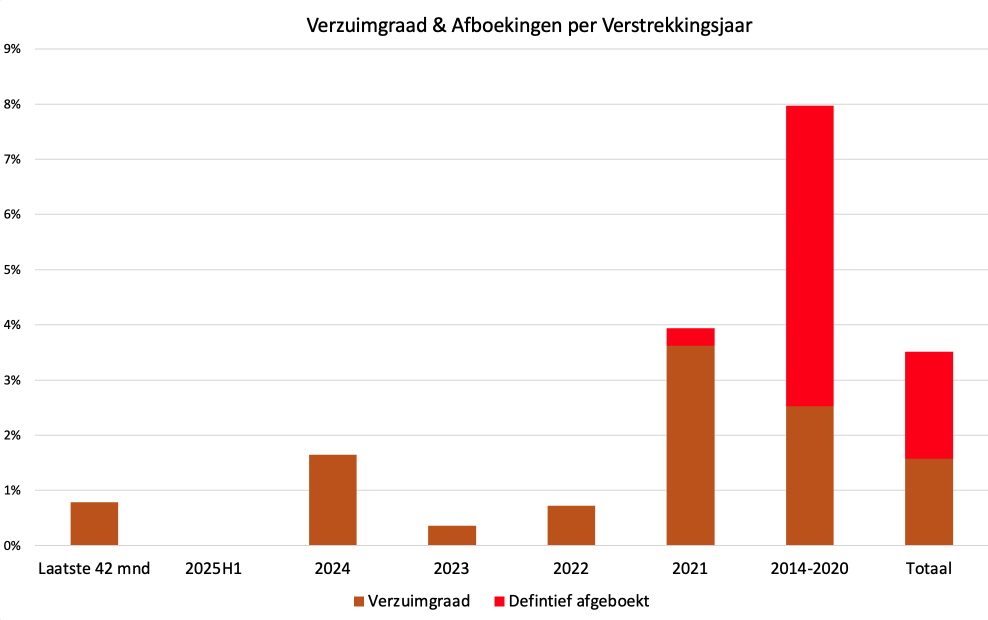

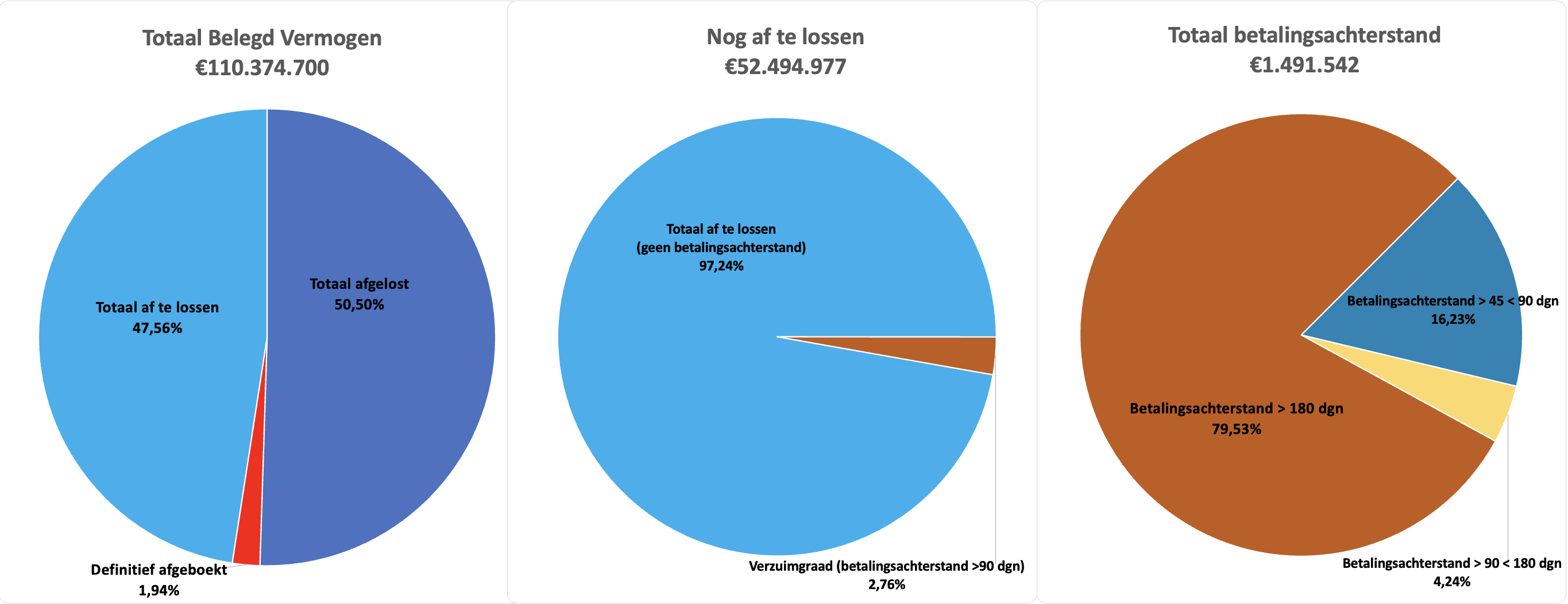

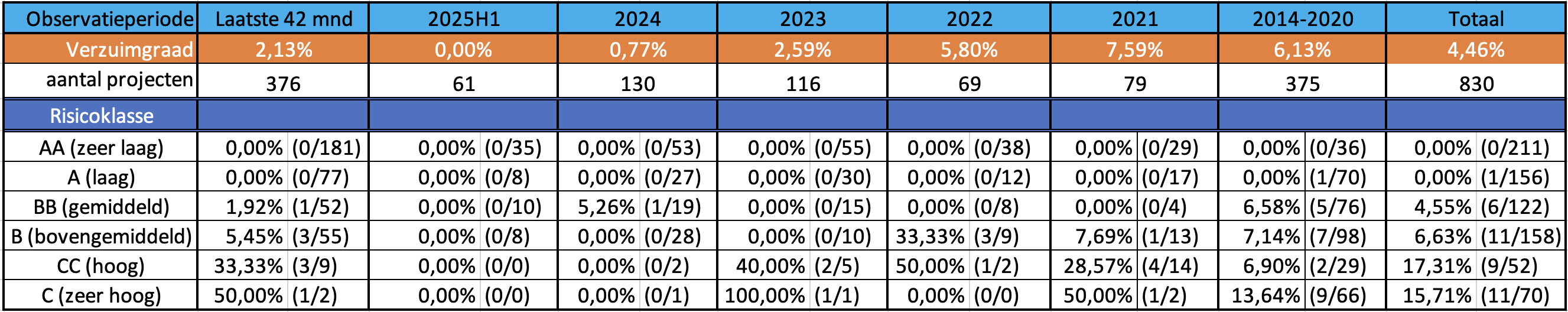

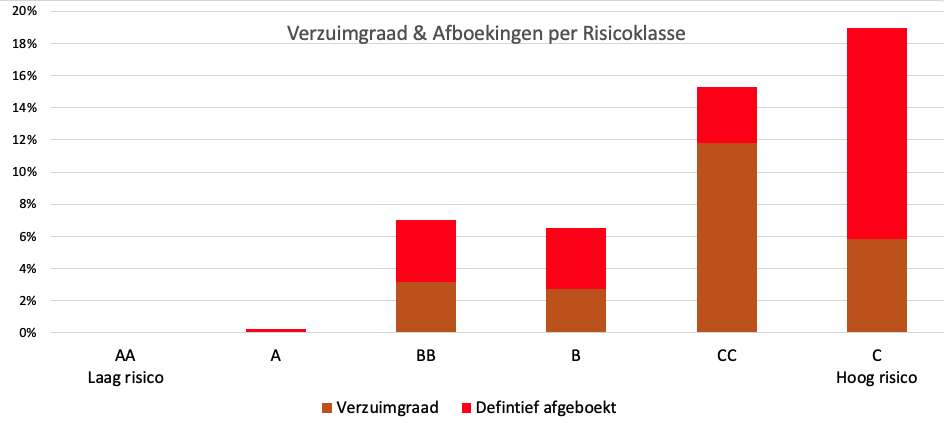

Onderstaande grafieken en tabel geven de statistieken weer van de lening portfeuille van Capital Circle t/m het tweede kwartaal van 2025. Dit wordt periodiek bijgewerkt.

Conform de Europese Wetgeving zijn wij verplicht om de verzuimgraad weer te geven op basis van het aantal projecten. De tabel hieronder is een actueel overzicht van deze Veruimgraad op basis van het aantal projecten dat gedurende de aangegeven periode succesvol is gefund via Capital Circle, tevens uitgesplitst naar risicoklasse;

Actuele cijfers

Stand van zaken per 1 september 2025 voor KOM Group (deze lijst wordt periodiek bijgewerkt);

Totaal saldo:

Totaal verstrekte leningen: € 107.792.300 (798 projecten)

Totaal afgelost: € 68.446.127

Totaal uitbetaalde rente: € 12.053.177

Nog af te lossen: € 39.226.691

Definitief afgeboekt: 1,94% (63 projecten, waarbij een deel van de hoofdsom definitief is afgeschreven)

Verzuimgraad: 0,78% (15 projecten, over de laatste 42 maanden met een betalingsachterstand van minimaal 1 termijn van meer dan 90 dagen)

Kapitaal op Maat maakt geen onderscheid tussen de werkelijke Verzuimgraad en de verwachte Verzuimgraad. Dus de historische Verzuimgraad kan aangenomen worden als de te verwachte Verzuimgraad.

Projecten conform afspraak afgelost: 448

Netto rendement: 5,91% per jaar op portefeuilleniveau (over de laatste 36 maanden, bron; Exaloan)

Netto rendement is ongewogen en zonder herbelegging van rente en/of aflossingen.

De Internal Rate of Return (IRR), dus met herbelegging van ontvangen rente is 6,77% per jaar (sinds de start in 2014, bron; Exaloan)

Voor meer informatie, zie onze pagina Performance Analyse met weergave van de brondata van Exaloan.

Openstaand saldo:

Geen betalingsachterstand: 244 projecten (van de 287 nog lopende projecten) voor een bedrag van €39.226.691

Betalingsachterstand: 34 projecten voor een totaalbedrag van €1.789.406 (100%)

Betalingsachterstand > 45 < 90: 0,0% (0 Projecten)

Betalingsachterstand > 90: 24,37% (3 Projecten)

Betalingsachterstand > 180: 75,63% (31 Projecten)

Alle projecten met een betalingsachterstand van >90 dagen vallen onder de Verzuimgraad en zijn in behandeling bij de Stichting Zekerheden. Deze projecten hebben de status 'Voorzien' en krijgt de financieringscirkel een gele kleur.

Verzuimgraad (Voorzien)

Begin 2020 is een nieuwe projectstatus geïntroduceerd voor projecten met een betalingsachterstand van meer dan 90 dagen. De ondernemer is hiermee In Verzuim. De status krijgt bij ons de naam Voorzien en de kleur geel. Binnen deze status hoeft geen sprake te zijn van incasso maatregelen of een afboeking. De communicatie over dit project met een status geel / voorziening of rood / afboeking loopt via Stichting Security Trustee KOM Group. De term Verzuimgraad is overgenomen uit de Europese Verordening voor Crowdfunding Dienstverleners (ECSP) die per 10 november 2021 van kracht is.

Definitie betalingsachterstand >45,of >90 of >180 dagen:

Met een betalingsachterstand van >45, >90 of >180 dagen wordt bedoeld de optelsom van alle achterstallige termijnen (incl. rente) bij leningen waarvan de ondernemers minimaal 45, 90 of 180 dagen vertraagd zijn met betalen ten opzichte van de bij het ophalen van de funding afgesproken aflossingsdatum of aflossingsdata. De ondernemers zijn In Verzuim en zijn in beeld bij de StichtingZekerheden Capital Circle.

Definitie Totaal Voorzien / Definitief afgeboekt & Afgerond:

Met het totaal aan totaal voorzien of definitief afgeboekte bedragen (in bancaire termen een ‘Default’) worden alle bedragen bedoeld waarvan redelijkerwijs verwacht wordt dat deze niet meer terugbetaald zullen worden aan de investeerders en dus als afboeking worden gezien. Daarbij is gedeeltelijke afboeking van leningen mogelijk indien er gedeeltelijke aflossing heeft plaatsgevonden. Een faillissement hoeft niet per definitie een (volledige) afboeking te betekenen indien naar redelijke verwachting de lening dankzij uitwinning alsnog kan worden afgelost. Veelal worden deze posten voorzichtigheidshalve "totaal voorzien" zolang de opbrengst en de bijbehorende kosten vanuit de uitwinning van de gestelde zekerheden onzeker is (tenzij sprake is van een hypothecaire inschrijving). Als de uitwinningsprocedure vanuit de Stichting Security Trustee KOM Group is afgerond en nog een gedeelte van de hoofdsom openstaat, wordt het project afgerond en het restant van de hoofdsom definitief afgeboekt.

Hieronder een actueel overzicht van de Verzuimgraad en Afboekingen o.b.v. funding volume per risicoklasse;

Definities

Periodiek publiceren wij actuele Facts & Figures. Onderstaand de definitie ervan.

Totaal geïnvesteerd

Het totaalbedrag wat door investeerders is gefund sinds de lancering van het platform in februari 2014.

Gemiddelde doorlooptijd

Het gemiddeld aantal dagen wat een project nodig heeft voor een 100% succesvolle crowdfunding.

Projecten gefinancierd

Het totaal aantal projecten wat door investeerders succesvol is gefund sinds de lancering van het platform in januari 2014.

Gemiddeld netto rendement

De door de investeerder gemiddeld ontvangen rente minus afboekingen en kosten. Conform de formule van de Branchevereniging Nederland Crowdfunding.

Voorbeeldsituatie van 1 mei 2022:

Gemiddelde rente: 6,88%

Minus de Verzuimgraad: 2,61%

Minus kosten: 0,15%

Netto rendement: 4,12%

Verzuimgraad (Voorzien)

Begin 2020 is een nieuwe projectstatus geïntroduceerd voor projecten met een betalingsachterstand van meer dan 90 dagen. De ondernemer is hiermee In Verzuim. De status krijgt bij ons de naam Voorzien en de kleur geel. Binnen deze status hoeft geen sprake te zijn van incasso maatregelen of een afboeking. De communicatie over dit project met een status geel / voorziening of rood / afboeking loopt via Stichting Security Trustee KOM Group. De term Verzuimgraad is overgenomen uit de Europese Verordening voor Crowdfunding Dienstverleners (ECSP) die per 10 november 2021 van kracht is.

Rente gemiddeld

Percentage van alle gepubliceerde, gefinancierde, aflossende en succesvol gefinancierde projecten bij elkaar opgeteld gedeeld door het aantal projecten afgerond op 2 decimalen.

Gemiddelde investering

Het gemiddeld geïnvesteerd bedrag in een crowdfunding project.

Totaal Voorzien

Een project wat de status 'Totaal Voorzien' heeft, wordt op het platform aangegeven met een rode rand eromheen. Het bedrag wat nog te vorderen is wordt vermeld en wordt weergegeven door het donkerrode gedeelde van de cirkel. Deze post is opgenomen om de economische waarde van de uitstaande leningen te schatten. Deze schatting is uitgevoerd door Stichting Security Trustee KOM Group. Tevens staat beschreven wat de status van deze vordering is. Alleen betrokken investeerders in een dergelijk project kunnen de details vanuit hun account raadplegen.

Hieronder een actueel overzicht van de Verzuimgraad en Afboekingen o.b.v. funding volume per verstrekkingsjaar;